Small Pacific nations are accruing ever greater amounts of debt to China. The US and its friends – including New Zealand – are anxious about what might happen if it can’t be repaid. National Correspondent Lucy Craymer reports in the second of a new five-part series, Pawns of the Pacific.

Drive from the airport to Nuku'alofa, Tonga and on the side of the road, you’ll see a ‘China Aid’ sign erected outside a school.

Take the road between Nadi and Suva, and you’ll spot a recently-built hospital made with Chinese money. There is a sign etched into the peach wall to remind passers-by: China funded it.

And in Papua New Guinea’s capital, Port Moresby, there is a plaque complete with a China Aid sign, reminders that the government sought Chinese money and labour to build the road ahead of the 2018 APEC conference.

Tonga, Samoa, and Vanuatu are among those most heavily indebted to China anywhere in the world. Tonga owes over 50 per cent of its public debt to the superpower. Papua New Guinea has high levels of hidden Chinese debt, according to AidData, a US-based research project into government debt.

And this is a worry. China has no real history of forgiving debt if countries find themselves unable to repay, raising questions about what happens if governments default on their loans. This has led to accusations that Beijing is partaking in debt trap diplomacy – lending in part to increase its political leverage.

“There is a real challenge around the level of loans that have been put into specific countries,” Foreign Minister Nanaia Mahuta said late in 2021 as she differentiated this type of aid from New Zealand’s largely grant-based giving and noted the economic vulnerability created by the debt.

But for the countries themselves, the identity of the lender is secondary to just meeting the needs of their people.

“There is a propensity to make a big issue about the relationship with China. We look at issues of debt financing from the same lens and if we need debt we will take out debt and if we don’t need debt we won’t take out debt,” says Garth Henderson, Financial Secretary of the Cook Islands.

The ‘debt trap’ debate is a key feature of wider diplomatic concerns of many Western nations about China’s surging role in the Pacific.

A Stuff investigation, with reporting from nations across the Pacific, has examined this growing power struggle. Over five parts, ‘Pawns of the Pacific’, explains how our island neighbours are caught in a geopolitical standoff between an increasingly aggressive China on one side and an increasingly alarmed United States, and its allies and friends, on the other.

You are reading part two of the series.

Where is the money going and what sort of money are we talking about?

A key driver for the increased Chinese aid and grants is the ‘Belt and Road’ initiative. Officially aimed at building infrastructure across the globe and improving economic development, Belt and Road is widely seen as a way of China building its influence.

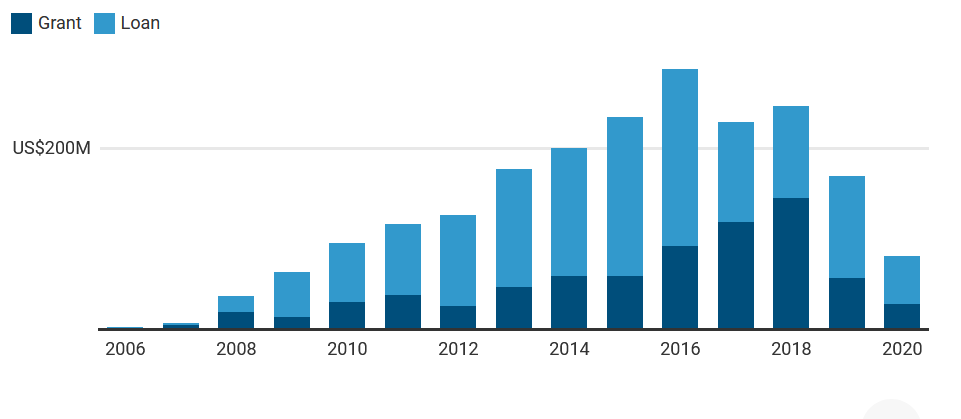

China’s annual international development finance commitments hover around $127b a year, which outstrips the US and other major powers by about two-to-one or more, according to AidData. Roughly $3b of Chinese aid – grants and loans – has gone into building new hospitals, wharves, roads, government buildings, sports stadiums and schools in the Pacific since 2006.

While China’s aid to the region fell in 2019, the value of loans went up.

“These nations are small, and they have limited debt windows, and they have a lot of Chinese projects,” says Jonathan Pryke, Director of the Lowy Institute's Pacific Islands Program. “You could question the quality of them and the cost of them – they have been expensive, and they have often been poor in quality.”

He adds that while there are concerns about the level of Chinese debt in the region he feels these are somewhat overblown. Largely, the terms are not predatory, and Pacific governments are wary about taking on new debt, he says.

So what is the problem with the money?

In short, government debt, like all debt, has to be repaid. These governments don’t have a lot of ways of doing that.

In 2018, the then-Tongan Prime Minister Akilisi Pōhivaraised concerns that China could seize buildings and assets in the Pacific. Its loans were about to come due, and it was unable to meet them. Days later, his tune changed: Pōhiva said he was grateful for China’s help.

China had granted Tonga a reprieve. Even so, they are going to have to borrow even more to meet their loan repayments, according to the International Monetary Fund.

US officials and some academics have criticised China for, they say, trapping countries in debt that they struggle with – or are unable – to pay off.

In one well-known example, the Sri Lankan government was struggling to pay back loans for infrastructure projects including a port in Hambantota that China had helped build. To settle this particular loan, it awarded a Chinese state-owned company a 99-year lease for the port and surrounding land. This was controversial given the location – it is near the coast of China’s rival India and provides the country with a foothold in a critical waterway.

READ MORE

- China Refuses to Pay Its Debt to Americans

- Why is China on the move in the South Pacific?

- China on the move...

Pryke adds given the size of Chinese lending around the globe, Beijing does not want to forgive debt because if it did for a Pacific country, it would have to do so for other countries like Malaysia or Pakistan, where the size of the debt is much greater.

The coronavirus pandemic adds to the Pacific’s debt story.

The International Monetary Fund estimates public debt in the Pacific rose to roughly 39 per cent of the region’s GDP in 2021, up from 33 per cent in 2019.

The Asian Infrastructure Investment Bank, China's rival to the World Bank, is becoming a key vehicle for the cash. Both Fiji and the Cook Islands have taken on new AIIB loans in the past two years.

Zong Bin, head of the political section of the Chinese Embassy in Wellington, says in an email the debt problem in the Pacific is essentially a problem of underdevelopment and the fundamental solution is to enhance development capabilities.

“China has been committed to creating a favourable international environment for developing countries,” she says. China never attaches any political conditions to its cooperation with island countries and never imposes its will on them, she says.

However, in exchange for aid, Beijing does often ask that contracts favour Chinese companies to build the funded projects. This has caused problems.

In 2014, a refurnished $90m national medical centre opened in the Samoan capital of Apia. Built by Shanghai Construction Engineering Group, a building firm owned by the municipal government, the hospital was billed as lifting health services in the country to another level.

Then issues started appearing. Tiles were falling off the walls, the elevators consistently didn’t work, the air conditioning had broken down, the restrooms smelt, and the toilets were constantly out of use.

The hospital maintenance staff were left to fix the restrooms. But just one of the five lifts continues to operate.

“There’s a joke in Samoa where if you see a breakable product or anything that doesn’t last long, they call it a ‘Made in China’ product,” says Apiseta Samuelu, a 54-year-old from Magiagi. That doesn’t mean people don’t buy Chinese products. “They’re cheaper.”

The other problem with Chinese projects is they largely use their own labour, so they do not provide jobs or opportunities for local businesses. It also often leaves no one able to fix the problems when the Chinese workers head home. While it’s a criticism regularly levelled at China, they are not alone in this.

In the Solomon Islands, Chinese companies have taken on a bigger role. A Chinese company is building the Pacific Games Stadium project in Honiara, funded by a Chinese grant.

While the government declared that work had created over 100 construction jobs for locals, at least 120 workers were flown in ahead of the $74m build from China.

Peter Iroga, owner of a local construction company Best Builders, says that everything has changed since Chinese companies started operating in the Solomon Islands.

“Chinese companies have the resources (material) to work, they have the company to manipulate the system and cheaper labourers to do the work. We locals can’t compete,” he says.

He says that this is going to have long-term effects as local firms are going to find it harder to keep businesses running, and more qualified builders will become unemployed.

Only those with money and connections to those in power will benefit, he believes. Recent protests and riots in the capital of Honiara were in part blamed on preferential treatment of foreign companies and a sense of frustration, alienation and disenfranchisement with the government.

Where is everyone else?

While China has traditionally financed infrastructure projects, countries like New Zealand have looked to spend money on programmes such as those to prevent family violence and encourage education, with the idea that these have a longer term impact on development than a new stadium.

Japan has long been a significant donor to the region but many of its programmes – such as paying to stop oil leaking from wartime wrecks in Palau and the Marshall Islands – just don’t garner the same publicity.

Koichi Ito, Japanese ambassador to New Zealand, says Japan faces a dilemma in that it wants to be a responsible donor, meaning its projects are assessed before any money is handed over. That is not the case for “other countries,” he says – carefully avoiding naming those countries.

Japan has started a series of infrastructure projects in the region, including upgrades of airports in Palau and the Solomon Islands. Between 2009 and 2019, just 14 per cent of Japan's aid to the region came in the way of loans, according to data from the Lowy Institute.

New Zealand’s support for Pacific budgets has increased during Covid, says Jonathan Kings, Deputy Secretary of the Pacific and Development Group at the Ministry of Foreign Affairs and Trade.

“A lot of the countries have high debt burdens, so they can’t borrow and in fact you don’t want them to borrow because that increases their long term dependency,” Kings says.

New Zealand’s work in the Pacific tends to come through grants with projects that tend to be more aimed at upskilling and improving the quality of life, rather than the more headline-grabbing infrastructure projects, such as sports stadiums.

Kings adds that because of this, New Zealand doesn’t often find itself competing with China on who can give something.

But he says there “is always an element of competition.”

At the same time, there is more need than ever for infrastructure, not least to counteract the impact of climate change in the region. New Zealand has set aside millions for climate change finance much of which is earmarked for the Pacific region.

In 2019, Australia launched an infrastructure financing facility for the Pacific – it was made up of around $540m in grants and $1.6b in loan financing that would support infrastructure development in Pacific and Timor-Leste over seven years. The Australian infrastructure loan program is sold as preferential as it focused on sustainability – loaning at levels that governments’ are able to service and repay.

Patricia Forsythe, the Australian High Commissioner to New Zealand, says they’re working with countries to look at how to build new strategic infrastructure such as ports, airports and telecommunications networks.

“We don’t want to see countries laden with debt. We do want to find ways that they can grow their infrastructure and modernise their infrastructure.”